SearchUser loginOffice of CitizenRest in Peace,

Who's new

|

Council Rep Santana notified of delinquent propertiesSubmitted by lmcshane on Tue, 04/02/2019 - 06:49.

Hello Councilwoman Santana,

You asked me to mail the parcel numbers for the properties owned by Ginmark/aka White Gold. Here are the parcels and the delinquent taxes on the properties:

Parcel Number, Deeded Owner, Address, City, State, Zip Code

015-25-027,"WHITE GOLD PROPERTY MANAGEMENT, LLC","3780 W 25 ST",CLEVELAND, OH,44109 $5,356.12

015-25-028,"WHITE GOLD PROPERTY MANAGEMENT, LLC","3784 W 25 ST",CLEVELAND, OH,44109

$19,601.46

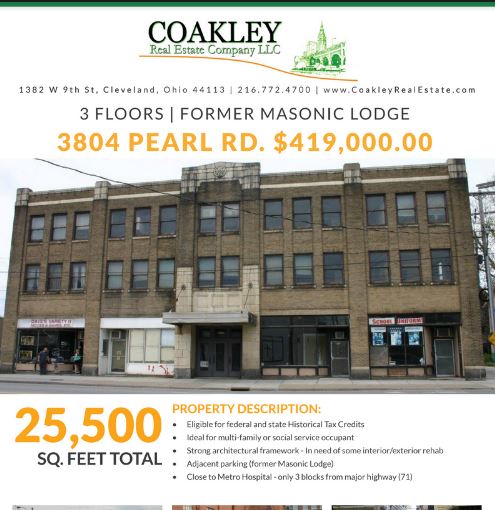

015-25-031,"WHITE GOLD PROPERTY MANAGEMENT, LLC","3804 PEARL RD",CLEVELAND, OH,44109 As you know - Joe Pagonakis recently helped a senior resident who has been living next to a vacant house 015-19-129 3310 Virginia w/unpaid $19,584.05 property taxes.

This pattern of unpaid taxes and blight was also the precursor to the eventual transfer of the YMCA building on W 25 to the Cuyahoga County Land Bank, which wited out $118K in unpaid taxes, and then transfered to Cleveland Housing Network. It has also been the pattern to wipe out these tax liens as with 3025 W 25th St. $20,813.73 wited out. I am calling these properties to your attention and to the attention of Cuyahoga County Council rep Dan Brady--to help residents avoid the same wait-and-see nightmare we have endured time-and-time again with these properties.

FTR - it is appalling that residents will be stuck for twenty years or more w/zombies from the CHN-Eden project-folks who are warehoused in these fraudulent PSH Housing projects. Brian Cummins, your predecessor in Cleveland City Council, could have stopped the Land Bank set up, if he had pressed for foreclosure on the $118K in unpaid taxes on those parcels 3881 W 25th St. Ironically, former County Treasurer Jim Rokakis and County Prosecutor Tim McGinty did not press for foreclosure on the YMCA building, but did pursue$11,763 K for an adjacent land owner Lloyd Glover.

And, as it stands, there is still the highly suspicious transfer of 3873 W. 25th to the Cleveland Housing Network - an industrial property that WAS NOT condemned and was demolished by the Cuyahoga County Land Bank at taxpayer expense. Taxpayers will never recoup the loss of tax revenue and costs for asbestos remediation and demolition on these properties.

I am asking your office to push for accountability with the Ginmark/White Gold properties. This outfit was also investigated by Joe Pagonakis, because Ginmark operated as a demolition contractor for the Cuyahoga County Land Bank, while delinquent on the properties on W. 25th St.

Brian Cummins touted these "landlords" - August Garfoli and John McCartney representing Mark Brookins of Ginmark -as heroes for "renovating" the Masonic Building. There should be enough information in this email to pursue foreclosure on the parcels now held under the White Gold name.

Sincerely,

Laura McShane

( categories: )

|

Recent commentsPopular contentToday's:

All time:Last viewed:

|

CHN plans 30 more LITC houses around Metrohealth

Apparently - no one is interested in the story, because as cub reporter Sam Allard informed me "No one likes you." Well, I

guess it is an honor I will have to bear, since the Cuyahoga Land Bank is racketeering and Cleveland Housing Network and Neighborhood Housing Services are part of their

"cabal."

Jasmin Santana needs to pursue delinquent property owners in Ward 14 - the media has been informed. Cleveland Council

persons have to sign off on demolitions and Cleveland Housing Network has another "International Village" planned for the Metrohealth area. Dan Brady knows all about it, too.

Tax Bill

Ginmark aka White Gold - was a CCLB demo contractor - demo monies are drying up. Have to save those dollars for CHN projects...pls see my original post.

Sam Allard should give equal time to analyzing Brancatelli -how his wife was recipient of public monies through contracts with the Cuyahoga County Land Bank, which Brancatellli chairs. Board structure at CCLB also needs scrutiny as they don't vote on the monies spent by CCLB. The CCLB basically operates with no oversight by design. There is also question of how CHN-Eden operates in collusion with the CCLB. Transfer of a commercial and industrial property cleared by taxpayers - over $118K wited out and over $400K in demolition and asbestos removal costs for 3873-3881 W 25. Dan Brady is now being given life support to resuscitate his political presence so he can take over in event Budish is forced to resign, which looks highly likely at this point. Dan Brady has control over District 3, which includes Metrohealth and Jasmin Santana, Cleveland City Councilwoman Ward 14 has to sign off on property transfers and demolitions through the CCLB. She recently signed off on "unplanned" demolition at 3310 Virginia thanks to reporting by Joe Pagonakis who also revealed that CCLB contractor Ginmark - now White Gold was allowed to operate for the CCLB while delinquent on property taxes. https://www.news5cleveland.com/.../cuyahoga-land-bank...

The 50 page report found millions of tax dollars issued though the Ohio Housing Financing Agency could fall victim to unfair competitive practices in the issuing of demolition contracts, including the potential for bid rigging and contract steering.

HEADS UP Ohio Housing Finance Agency - Detroit Shoreway has another CHN LITC application in the works - no conflict since CHN Partners real estate manager used to work at DSCDO....

Waiting for an answer -

FHA50 - Santana CF is not your only neighborhood

Where is this new grocery store going to be located along the Metrohealth RTA line? May I please suggest the old Aldis location 3787 Pearl Rd, Cleveland, OH 44109, which served our senior community and was directly available to bus the #51 line, which operates 24/7 w/greater frequency than other bus routes.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Grantee(s) Grantor(s) AMVF HOLDINGS LLC PEARL FDBTS, LLC

Grantee(s) Grantor(s) PEARL FDBTS, LLC Aldi Inc

Housing Court >BOR Ron O'Leary Land Bank pal

Board of Revision can take one of two remedies - administrative foreclosure or sheriff sale. Thanks to Marc Dann - the machinations at the Cuyahoga County Land Bank are NOW under scrutiny

https://www.wcbe.org/post/supco-upholds-foreclosures-dont-compensate-owners-or-taxpayers

I have notified my council rep and the media to the Land Bank's next intended wite out. NOTE: the value assigned to the building:

Ms Donald at City Hall - has referred both properties to Housing Court. Asking that this NOT be referred to Ron O'Leary at BOR for administrative foreclosure. The White Gold partners included August Garfoli - son of a former Cleveland Council person. He is deceased the current slum lord - John McCartney lives in Strongsville and is VERY politically connected.

Brancatelli will want this referred to Land Bank for tax wite out. Please stay on top of this property - they are crooks. Also ran fake demolition contractor outfit Ginmark

Masonic Building status August 2021 -hot housing market

Carnegie South Branch Library